Sunday, December 07, 2025

Sunday, December 07, 2025

by Natja Igney:

This is the second in a series of three articles, each examining a critical phase of crisis communications and reputation management. While tactical responses are typically assigned to middle management, strategic responsibility – including the public-facing role – lies unequivocally with the C-suite.

The three installments address:

PART 2: When Performance Under Pressure Becomes Reputational Currency

Executive Summary

For boardrooms and leadership teams, the message is clear: in an age of instantaneous scrutiny, crisis leadership has become a strategic competency and a source of durable competitive advantage. Your next crisis might be your biggest competitive opportunity… if you are prepared for it.

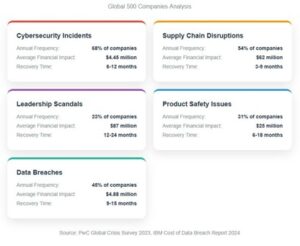

This second article in a series of three focuses on the crucial role of the C-suite in managing sudden, high-impact disruptions. Using a real-world case study with detailed analysis, it illustrates how strategic visibility, timely communication, and stakeholder alignment can determine whether a crisis becomes a reputational catastrophe or a moment of brand reinforcement. Drawing on tables and data from PwC, IBM, and other well-founded sources, the article outlines the financial, reputational, and operational consequences of leadership performance. It also provides numerous takeaways to guide C-level leaders in their decision-making.

The 72-Hour Trust Window

Before examining specific cases, executives must understand a critical finding from recent crisis research: stakeholder trust crystallizes within 72 hours of crisis onset. After that window closes, perceptions become exponentially harder to shift. This “72-Hour Trust Window” explains why immediate executive visibility matters more than perfect information.

The implications are profound. Modern crises do not end but rather just fade into background competitive disadvantage. Organizations that fail to establish trust in those crucial first three days find themselves operating from a position of permanent skepticism, affecting everything from customer retention to talent acquisition to regulatory treatment. \

| Time Elapsed | Executive Action Needed | Stakeholder Reaction |

| 0–24 Hours | Immediate acknowledgment and presence | Confusion and uncertainty |

| 24–48 Hours | First detailed messaging | Formation of first public narratives |

| 48–72 Hours | Clarify knowns/unknowns + plan forward | Trust stabilizes—or fractures |

| > 72 Hours | Too late to shape core perception | Narrative calcifies, hard to shift |

The following case studies demonstrate how two organizations performed within this critical window, with dramatically different results.

CASE STUDY: Singtel and UnitedHealth – A Tale of Two Responses

Let us compare one exemplary executive PR response with a mishandled one:

Singtel: A Masterclass in Executive Crisis Management

The handling of a major data security breach at Singtel, the Singaporean telecommunications conglomerate set a benchmark worldwide. In the early morning hours of January 20, 2021, the company confirmed a vulnerability in the third-party file transfer system Accellion FTA, which had exposed personal data belonging to more than 129,000 individuals. Within hours, group CEO Yuen Kuan Moon issued a public apology, accepted responsibility, and detailed the containment and remediation steps already underway.

Executive visibility was immediate. Singtel engaged regulators proactively, kept affected customers informed, and communicated the scope of the breach with clarity and consistency. The company’s tone was direct, the messaging regular, and the emphasis firmly placed on transparency and accountability – a posture that helped preserve public trust and mitigate reputational fallout.

CEO Moon’s instant response to a serious incident followed communication protocols developed through years of crisis simulation, demonstrating that authentic crisis communication is the result of rigorous preparation rather than spontaneous emotional expression.

UnitedHealth: CEO falls off the radar

The contrast with the February 2024 ransomware attack on Change Healthcare, a core technology subsidiary of UnitedHealth Group, could not have been starker.

In February 2024, Change Healthcare, a core technology subsidiary of UnitedHealth Group, suffered one of the most extensive data breaches in U.S. healthcare history. Acquired in 2022, Change Healthcare plays a critical role in processing approximately half of all medical insurance claims in the United States.

The incident paralyzed claims processing nationwide and potentially exposed data from nearly 190 million individuals. Yet for ten weeks, then-CEO Andrew Witty made no public appearance and issued no direct communication.

In the vacuum, frustration grew. Patients received little information, hospitals faced mounting disruption, and federal regulators criticized the company’s lack of transparency. UnitedHealth ultimately advanced over $3.3 billion in interest-free loans to stabilize affected healthcare providers, and reportedly paid a $22 million ransom to the attackers. But even these substantial financial measures did little to offset the reputational damage caused by the protracted silence from executive leadership.

The Anatomy of Contrasting Crisis Responses

These two cases, separated by three years and two continents but united by their global applicability, illustrate how in crisis, your leadership style becomes your brand strategy. The gap between immediate technical remediation and lasting reputational damage reveals how stakeholder perceptions often matter more than operational fixes.

Crisis Leadership as Market Signal

What many executives fail to recognize is that crisis performance has become a powerful market signal. Competitors, investors, and top talent now evaluate organizational resilience based on how leadership performs under pressure. Singtel’s handling of their breach went beyond preserving customer trust: it signaled to the market that this was an organization with superior leadership depth and preparation.

The UnitedHealth CEO’s prolonged public absence sent the opposite signal: an organization whose leadership was unprepared for the pressures of modern business. It created what is known as “the Silence Tax”: every day of CEO silence during crisis costs exponentially more in reputation recovery than immediate transparency would have required. The reputational damage extended far beyond the immediate crisis, affecting everything from regulatory scrutiny to competitive positioning in subsequent business development opportunities.

TAKEAWAY:

WHY DECISIVE LEADERSHIP MATTERS

The Global Stakes of Crisis Leadership

Corporate crises have become both more frequent and more financially devastating. PwC’s Global Crisis and Resilience Survey 2023 found that 89% of business leaders now consider resilience one of their most important strategic organizational priorities, yet many organizations remain unprepared for the leadership challenges that crises present.

The digital acceleration of crisis timelines has fundamentally altered the executive playbook. Information spreads within minutes across global networks. Stakeholder expectations for immediate, authentic leadership response have intensified. Yet traditional corporate communication strategies, built for slower news cycles and more controlled information environments, often prove inadequate.

TAKEAWAY:

Modern crisis leadership requires a new core capability: communicating under extreme pressure.

Financial Impact of Crisis Leadership Quality

Leadership response and market performance are tightly connected. While at the onset of a crisis slight dents in the critical parameters are to be expected even under a top-performing CEO, a swift and decisive response typically limits financial losses, shortens recovery time and may even lead to wider brand recognition. However, even “average” crisis management already shows losses in brand confidence and financial results that are difficult or even impossible to recover from.

Instead of viewing crises as threats to be managed, truly strategic executives position them as opportunities to build competitive advantages that competitors can’t easily replicate. Companies that handle crises exceptionally well create what amounts to a ‘trust moat’, a durable reputational buffer earned through credible performance under pressure where stakeholders become more loyal because they have seen the organization tested and proven.

This trust moat becomes particularly valuable in industries where crisis incidents are inevitable. Organizations with proven crisis leadership capabilities can enter new markets, launch sensitive products, or navigate regulatory challenges with greater stakeholder confidence than competitors who have not been tested or have failed previous tests.

Source: Crisis Leadership Performance Study 2024, based on analysis of 150 global corporate crises

The Board’s Crisis Governance Role

While operational crisis management typically falls to the C-suite, boards bear ultimate responsibility for ensuring their organizations are prepared for leadership under pressure. This governance responsibility extends beyond post-incident review to active preparation and real-time oversight.

When crises hit, unprepared boards either micromanage (= paralyzing response) or disappear (= abandoning leadership). The most effective crisis leaders invest significant time in board education, establishing clear decision-making authorities and communication protocols before crises occur.

The board’s crisis governance role includes validating that executives have the training, temperament, and protocols necessary to maintain stakeholder trust during high-stress situations. For multinational corporations, this means ensuring leadership can navigate not only domestic markets but also the “Global-Local Paradox.” (More on that further below.)

TAKEAWAY:

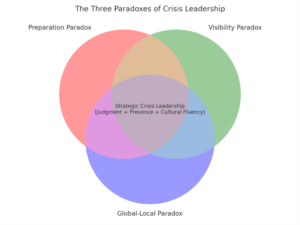

THE THREE PARADOXES

The Preparation Paradox

Despite the clear stakes, most organizations remain inadequately prepared for crisis leadership at the executive level. Here is where we encounter the “Preparation Paradox”: organizations that do not or only partially invest in crisis planning often perform worst in actual crises because they over-rely on scripts instead of developing leadership judgment but under-rely on professional coaching.

PwC’s survey revealed that 31% of respondents identified building a team with the right skills as a major challenge in establishing resilience programs, while 57% of organizations cite upskilling future leaders as one of their three most important elements of future-proofing resilience.

This preparation gap creates dangerous overconfidence. Written crisis plans provide operational structure but rarely prepare executives for the psychological stress and split-second communication decisions that real crises demand. The most detailed playbooks prove worthless if leaders freeze under scrutiny or default to defensive language that erodes stakeholder trust. The best crisis leaders are trained in peacetime, not during the storm.

TAKEAWAY:

The Visibility Paradox

Perhaps the most counterintuitive requirement of crisis leadership is appearing before stakeholders with incomplete information. The executive instinct to wait for perfect clarity proves disastrous in digital-first media environments where silence itself becomes a message.

Recent research shows that more than 50% of adults now get news from social media, accelerating information flow and speculation. In this environment, stakeholders do not expect omniscience from leaders; they expect presence, authenticity, confidence, and engagement with uncertainty.

TAKEAWAY:

The Global-Local Paradox

For multinational organizations, the biggest crisis communication challenge is not linguistic translation but leadership behavior. What reads as “strong” in some cultures may come across as “arrogant” in others. There is no “one size fits all”. Global crisis leadership is about orchestrating contradictory perceptions.

A CEO’s direct accountability statement that builds trust in New York might be perceived as the culturally unacceptable “losing face” in Tokyo. The assertive transparency that European regulators expect could violate relationship-preservation norms in Southeast Asian markets.

This complexity multiplies during crises when cultural sensitivities are heightened and misunderstandings can escalate rapidly.

Smart organizations understand that the solution lies in strategic message layering and cultural amplifiers, and craft a core message framework that remains consistent globally, then deploy local cultural translators – not just linguists, but cultural insiders who understand behavioral expectations – to adapt delivery style, spokesperson selection, and emphasis points for each market.

For instance, while the factual content about a product recall remains identical worldwide, the New York audience might hear from the CEO directly taking personal responsibility, while Tokyo stakeholders receive the same information through a trusted local partner who frames it as collective organizational learning. European regulators get detailed compliance timelines, while Southeast Asian customers receive relationship-focused messaging that emphasizes long-term commitment to their communities.

| Region | Preferred Tone | Typical Spokesperson | Messaging Emphasis |

| North America | Direct, accountable | CEO | Speed, responsibility, transparency |

| Europe | Formal, compliance-focused | CEO or General Counsel | Legal clarity, public responsibility |

| Southeast Asia | Relational, community-centered | Local partner or liaison | Trust, continuity, long-term presence |

| East Asia | Respectful, collective | Regional executive | Harmony, deference, indirect delivery |

TAKEAWAY:

Leadership When Stakes Are Highest

Technical competence alone cannot protect organizational reputation when leadership falters. In the global economy, crisis communication capability has become as essential as financial controls or operational excellence.

The question facing executives is no longer whether their organizations will face crisis, but whether they possess the skills to lead effectively when reputation and stakeholder trust hang in the balance. The cost of learning these lessons in real-time continues to rise, while the competitive advantage of mastering them before crisis strikes becomes increasingly valuable.

While C-level leaders are usually highly educated in business disciplines, not all of them are expert communicators, especially when facing media and stakeholders in high-pressure situations. Strategic coaching is an excellent way of sharpening those skills, and ultimately one of the best business investments.

TAKEAWAY:

What’s Next?

The final article in this series, appearing in July 2025, explores strategies to mitigate reputational damage and to turn post-crisis recovery into a platform for renewed credibility and competitive positioning.

+++

About the Author

Natja Igney is an independent journalist and communications strategist with a global career spanning over 25 years in media, corporate communications, crisis communications, and reputation management. She provides specialized crisis leadership coaching for C-suite executives and boards globally, combining her expertise with psychological preparation for high-pressure decision-making to help prepare for and navigate complex stakeholder-facing situations. Dually based in France and Canada, she is fluent in English, French, and German. Visit her website and connect with her on LinkedIn.

Written by: Editor

© 2025 Stratpair Ltd., trading as Strategic. Registered in Ireland: 747736